News

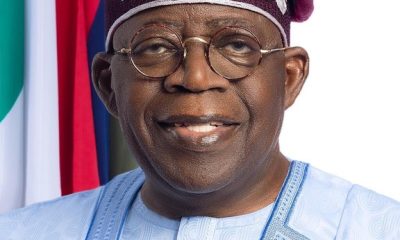

Tinubu administration heralds improved executive-legislature relations – Buni

Gov. Mai Mala Buni of Yobe, on Sunday says the legislative background of President Bola Ahmed Tinubu and Vice President Kashim Shettima heralds improved executive-legislative relations for the country.

Buni, in a statement by his Director-General Press and Media Affairs, Alhaji Mamman Mohammed in Damaturu, said the Tinubu administration ”is a meeting point of the executive and legislative arms of government that could fast track development.

“Tinubu, Shettima and the SGF, George Akume were former Governors and Senators, while the newly appointed Chief of Staff, Mr Femi Gbajbiamila is the outgoing Speaker of the House of Representatives, making it a unique team.

“Their excellent backgrounds in the executive and legislative arms give them advantage to partner the National Assembly to execute government policies and programmes without or with less confrontation.

“Their backgrounds in public offices have no doubt prepared them for the task of delivering dividends of democracy to Nigerians with ease.

“I congratulate the President for making the right choice, and the new appointees, the Chief of Staff (COS) and Secretary to the Government of the Federation (SGF), for the opportunity given to them to serve the country.”

The governor assured the support and co-operation of the government and people of Yobe to the Federal Government led by Tinubu.

Buni solicited the co-operation of all Nigerians to the new administration for a successful take-off to meet the needs and expectations of Nigerians.

News

Woman killed while crossing road in Anambra

The Federal Road Safety Corps (FRSC), Anambra State Sector Command, has confirmed the death of a woman in an accident at Okpoko Market on the Asaba-Onitsha Road.

The Sector Commander, Mr Adeoye Irelewuyi, who confirmed the accident to journalists in Awka on Thursday, said that the woman was hit while she was crossing the road.

He said that the accident, which occurred on Wednesday, involved a commercial tow truck with registration number XA550BMA.

“Eyewitness report reaching us indicates that the truck was towing a vehicle in an uncontrollable speed along the axis.

“The vehicle that was being towed got detached from the tow truck.

“It hit and killed a female adult, who was said to be crossing the road, while the tow truck continued its movement.

“FRSC rescue team came to the scene and took the woman to Toronto Hospital, Onitsha, where she was confirmed dead and her body deposited at the hospital’s mortuary,” he said.

While sympathising with the family of the dead, the sector commander urged motorists, especially tow truck drivers, to exercise a high level of professionalism.

He also urged the drivers to always use standard equipment and avoid speeding.

News

LASG’s maize palliative impactful, says poultry association chair

The Chairman, Poultry Association of Nigeria (PAN), Lagos State Chapter, Mr Mojeed Iyiola, said the state government’s maize palliative to members of the association made a positive impact on the sector.

Iyiola said this in an interview with the News Agency of Nigeria (NAN) on Thursday in Lagos.

“We received about 150,000 tons of maize in February from the Lagos State government as palliative to cushion the effect of high feed prices.

“The major benefit of the palliative is that it actually cushioned the cost of production for most poultry farmers in the state.

“The palliative was beneficial as it made the cost of some poultry produce, especially eggs to drop,” Iyiola said.

He noted that prior to the palliative, a crate of egg was sold between N3,500 and N3,700 at the farm gate, but after the palliative, it now sells between N3,200 and N3,400.

According to the PAN chair, retailers and middlemen who sell from N3,800 to N4,200 do that for their personal gain.

“We have urged our members to sell their eggs at reasonable prices following the receipt of the palliative from the government.

“We appreciate the Lagos State government for the palliative but we also urge the federal government to do likewise, to further reduce the cost of production in the sector.

“This will consequently lead to drop in the prices of all poultry produce across board,” he said.

He said the palliative was shared among financial members of the association at no extra cost.

“As an association we shared the grains equally across PAN’s eight zones in the state equally. We also mandated each zone not the sell even a grain of the maize.

“We, however, considered new poultry farmers who wanted to the join the association as beneficiaries of the palliative,” said Iyiola.

He noted that through the palliative, more poultry farmers were recruited into the association.

“The maize was shared only to poultry farmers and not feed millers, it is the major component of poultry feed formulation,” he said.

-

Business4 days ago

Business4 days agoSeplat Energy celebrates a decade of Dual Listing with Bell Ringing Ceremony at Nigerian Stock Exchange

-

News4 days ago

News4 days agoBDCs now buying dollar at ₦980 — ABCON President

-

Metro4 days ago

Metro4 days agoOsun Poly Student, Olanrewaju Olatona killed by hit-and-run one-way driver

-

Headline4 days ago

Headline4 days agoFagbemi warns against obstructing EFCC from performing its lawful duty

-

News4 days ago

News4 days agoLASG’s maize palliative impactful, says poultry association chair

-

News4 days ago

News4 days agoWoman killed while crossing road in Anambra