Tech

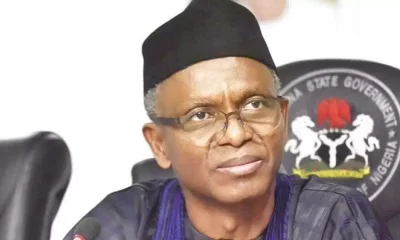

El-Rufai Launches $100 Million Afri-Venture Capital Company

Nasir El-Rufai may no longer be the Kaduna State governor and has missed a controversial ministerial appointment, but he certainly has not lost his zest for taking on big projects. The former governor is going into the private sector with a loud statement.

El-Rufai plans to launch a $100 million venture capital fund for startups in Nigeria, particularly those in the Kaduna tech ecosystem. He plans to match his ambitions with actions. He is willing to stake $2 million of his money for the offtake of the fund. He plans to convince investors to provide the remaining funding. The investors will mostly be those “who believe in us but don’t have the capacity or the time to do the analysis and evaluation. But they trust our judgment and they will come with us.”

He was in Marrakech in November for the Africa Investment Forum where he spoke to BusinessDay.

The former governor who played a significant role in the emergence of the current Nigerian president as the party’s candidate, seems to have put his disappointments behind him.

In Marrakech, there was no trace of the man who became the target of much social media trolling. The El-Rufai that showed up in Marrakech was looking spritely and took part in all the sessions of the Africa Investment Forum, a multi-stakeholder, multi-disciplinary platform with the vision to channel capital towards critical sectors to achieve the Sustainable Development Goals, the African Development Bank’s High 5s, and the African Union’s Agenda 2063.

According to him, he wants to set up a venture capital fund or private equity that will invest in young Nigerians with innovative ideas. It doesn’t matter what segment of the economy the ideas are. It could be in agriculture. ICT or the creative industry, so long as it has the potential to add value to the world, these are the ideas that El-Rufai and his fund will target.

During his tenure as governor of Kaduna, El-Rufai said he met many students in Kaduna who had great ideas and were creating innovations. However, many of them did not have someone to mentor them and help those ideas grow.

“What young people need is essentially mentoring and financing to get things going. They develop the idea and see whether it is viable. And we will open doors for them because they don’t have contact. They don’t know or have access to ministers, presidents, or regulatory agencies. We do. We know the minefields that they have to navigate. We know that they need to give them appointments and we can provide them with the startup funding and in return we take an equity position.

We don’t want to take your business; we want to develop it. But if we take the risk on you, we will take a percentage of the business,” El-Rufai said.

He is working with select private sector partners, including Eyo Ekpo, co-founder of Excredite Consulting Limited, and their primary focus is on Nigeria but the ambition is Africa because he projects from a report that Africa will be supplying the world with a significant portion of the workforce it needs by 2050.

According to a report by the Guardian, by 2050, Africa’s population is expected to reach 2.5 billion, which is about 25 percent of the world’s population.

El-Rufai says such projections call for more investments in the younger demographic. However, his fund will not just be focusing on new startups, there is also a plan to engage established companies with management problems that are still viable. The VC fund will invest in such companies, get them sorted out and take them to exit.

“We don’t intend to remain in any business. We want to catalyse growth in these startups,” he said.

One of the goals of being at the African Investment Conference was to seek continental partnerships, and investors and to explore opportunities with climate-focused investors.

“Nigeria has a lot to offer Africa and the world. Our population, entrepreneurial capability, the innovation of our young people and their boldness and courage to find success. We just felt that we have a duty to encourage,” he said.

The first fund will be investing for three to four years. The fund is expected to launch early next year and the company will be headquartered in Abuja. This is to diversify the funding beyond Lagos because there is already a lot of interest in funding innovation in Lagos. El-Rufai and his partners want to spur startup funding interest in ecosystems in Kaduna, Abuja and other parts of the country.

Tech

Top 10 States With The Highest Number Of Internet Users In Nigeria

The digital landscape in Nigeria has seen significant growth over the years, with more citizens gaining access to the internet.

This has been largely driven by improved telecommunications infrastructure, affordable mobile devices, and the growing digital awareness among the population.

As of the fourth quarter of 2023, data on internet usage across the country reveals fascinating insights into which states are leading in digital connectivity.

According to the data released by the National Bureau of Statistics (NBS) internet subscriptions in the country stood at 163.8 million at the end of 2023.

Based on the NBS data, here are the top 10 states with the highest number of internet users in Nigeria as of Q4 2024:

10. Delta (4.4 million)

Rounding off the list is Delta State, with 4.4 million internet users. Known for its oil production, Delta is also making strides in the digital world, contributing to the diverse landscape of internet users in Nigeria.

9. Katsina (4.6 million

Katsina State, with 4.6 million internet users, is another northern state on the list, showcasing the expanding reach of digital connectivity beyond Nigeria’s major urban centers.

This growth is a testament to the increasing awareness and adoption of digital technologies in the state.

8. Adamawa (5.4 million)

Adamawa State stands out in the northeastern region with 5.4 million internet users. Despite facing challenges, the state is making significant progress in digital inclusion, bridging the digital divide in the region.

7. Rivers (5.6 million)

Rivers State, with its capital in Port Harcourt, is not just an oil-rich state but also a burgeoning center for technology and innovation in the southern part of Nigeria, with 5.6 million internet users.

The state’s efforts in leveraging digital technology for economic development are evident in its internet usage figures.

6. FCT (5.8 million)

The FCT, encompassing Nigeria’s capital, Abuja, boasts 5.8 million internet users. As the administrative and political heart of Nigeria, it’s no surprise that the FCT is among the leaders in digital connectivity, with many government and private sector initiatives pushing for greater internet penetration.

5. Kaduna (7.4 million)

Kaduna State is another northern state making waves in the digital world, with 7.4 million internet users. The state has been proactive in embracing technology, aiming to become a northern tech hub, which is reflected in its growing internet user base.

4. Oyo (8.4 million)

Oyo State, known for its rich cultural heritage, is also making strides in digital engagement with 8.4 million internet users. Its capital, Ibadan, is becoming a significant tech cluster, fostering digital education and innovation.

3. Kano (9 million)

Kano, one of the largest cities in Nigeria’s northern region, comes in third with 9 million internet users. The state has historically been a center of commerce and trade, and its adaptation to digital transformation has been commendable, making it a leading state in the north for internet usage.

2. Ogun (9.5 million)

Following Lagos is Ogun State, with 9.5 million internet users. Ogun’s strategic position as a neighbor to Lagos and its efforts in improving its ICT infrastructure have made it an emerging center for technology and industrialization, attracting more people to the digital space.

1. Lagos (18.9 million)

Topping the chart is Lagos, the commercial hub of Nigeria, boasting an impressive 18.9 million internet users. The state’s advanced infrastructure, coupled with its status as a business and tech hub, significantly contributes to its high internet usage.

Lagos is not only the most populous city in Nigeria but also a melting pot of cultures and businesses, making it a hotspot for digital activities.

Headline

Bitmama acquires Payday

In a significant development in Nigeria’s fintech landscape, blockchain payments platform, Bitmama Inc. has confirmed the acquisition of Payday, a virtual card service provider.

The news comes barely nine months after Payday announced its $3 million seed round and three months after its exploration of sale options was confirmed. Facilitated through Bitmama’s cross-border payments product Changera, the acquisition marks a pivotal shift from earlier speculations, including a potential acquisition by lead investor, Moniepoint. Changera is set to consolidate its blockchain payment platform by acquiring 100% of Payday’s customer base.

A source close to the matter, who declined confirming the financial terms of the deal, revealed to Techpoint Africa that acquisition conversations were initiated just a few weeks ago, and the process is “about 85% complete.”

Changera, launched in 2021, is set to absorb a number of Payday’s key personnel across various departments, including marketing, customer service, and engineering. This integration is already underway, with some Payday employees already transitioning to Changera. As a founder with a strong technical background, Payday CEO Favour Ori’s integration into Bitmama’s team is not yet confirmed. However, given Bitmama’s already established leadership and robust technical team, it appears more likely that he may step away.

For the over 300,000 customers previously reported by Payday, who will now be under Changera’s care, there will be hopefully no noticeable changes.

According to a senior member of Bitama’s management, Payday’s brand will continue to operate but it will now fall under the broader umbrella of Changera, supported by its stablecoin infrastructure. This integration is expected to overcome the liabilities and challenges Payday faced due to its dependence on third-party integrations, thereby potentially improving both customer experience and service reliability. The self-proclaimed neobank of the gig economy had previously grappled with operational challenges, including industry-wide charge-back fraud issues, a notable disruption in Mastercard services, and the exit of senior team members in July 2023.

For Changera customers, the acquisition promises to expand the range of available services, providing access to Payday’s digital payment solutions.

In the short term, there are no planned changes to the fee structures or terms of service for Payday customers. However, as the integration progresses, customers can anticipate an expanded suite of services and potentially new features that leverage the combined strengths of Bitmama and Payday.

Post-acquisition, Bitmama is poised to embark on an ambitious roadmap. Central to this roadmap is the development of a new solution aimed at enhancing FX transactions for African businesses. Slated for launch in Q1 2024, this solution is expected to address a critical need in the market, facilitating smoother and more efficient B2B cross-border financial interactions.

The acquisition of Payday by Bitmama mirrors a broader trend of strategic consolidations within the fintech industry. It comes in the wake of similar acquisitions, such as that of Chaka by Risevest in September 2023. This consolidation trend suggests an emerging pattern where fintech companies are increasingly seeking strategic partnerships and acquisitions to overcome market challenges and scale operations.