Headline

Tips For Nigerian Students To Access Loan Scheme

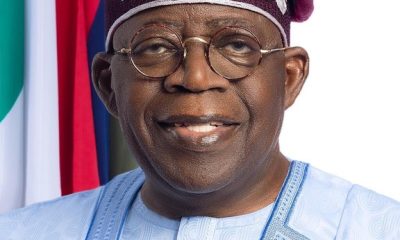

The signing of the Student Loan Bill into law by President Bola Tinubu on Monday has elicited commendations from the public, especially students.

The bill will enable Nigerian students access loans at interest-free rates.

It is also expected to see the establishment of an education bank.

In November 2022, the bill was passed by the National Assembly.

The bill was sponsored by Hon Femi Gbajabiamila.

Checks by The Nation shows the bill seeks the establishment of the Nigerian Education Bank, which shall have powers to supervise, coordinate, administer, and monitor the management of student loans in Nigeria

The board will also receive applications for student loans through higher institutions in Nigeria on behalf of the applicants, screen the applications to ensure that all requirements for the grant of students’ loan under the Act are satisfied.

In the copy sighted by The Nation, “The bank shall also have the powers to approve and disburse the loan to qualified applicants; control and monitor and coordinate the students’ loan account/fund and ensure compliance in respect of disbursement; monitor academic records of grantees of the loan to obtain information on their year of graduation, national service, employment to ensure that grantees of the loan commence repayment of the loan as at when due, among other functions.

“The Bill provides that notwithstanding anything to the contrary contained in other enactments, all students seeking higher education in any public institution of higher learning in Nigeria shall have an equal right to access the loan under this Act without any discrimination arising from gender, religion, tribe, position or disability of any kind.

“The loan referred to in this Act shall be granted to students only for the payment of Tuition fees. The grant of the loan to any student under this Act shall be subject to the students/applicant(s) satisfying the requirements and conditions set out under this Act.”

Here are things to know before applying for student loan:

1. Students applying for loan must apply to the Chairman of Nigerian Education Bank through their respective institutions.

2. They must have secured admission into any of the Nigerian Universities, Polytechnics, Colleges of Education or any vocational school established by the Federal Government or the government of any state of the Federation.

3. Applicant must provide at least two guarantors.

4. Each of the guarantors must be a civil servant of not less than level 12 years in service, or a lawyer with at least 10 years post-call experience; of a judicial office of a justice of peace.

5. All applications from every institution must be submitted through the Student Affairs Office of each institution via a list of all qualified applicants from the institution accompanied by a cover letter signed by the vice-chancellor or rector or the head of the institution and the students affairs officer and addressed to the chairman of the board of the bank.

Each application must be accompanied by the following:

1. Copy of student’s admission letter

2. Letter by the guarantors addressed to the chairman, governing board of the bank recommending the student for the loan and stating that he accepts the liability in the event of default.

3. Each guarantor must submit two passport photographs, name of the employer and evidence of being so employed by the named organisation.

4. Each institutions must ensure that all applications from its school reach the bank not more than 30 days after close of admission for the academic year.

5. Where the guarantor is self-employed, he must provide particulars of his business as registered with the CAC or any other appropriate authority.

A student can be disqualified from accessing loan if:

1. He is proven to have defaulted in respect of any previous loan granted by any organisation.

2. He has been found guilty of exam malpractice by any school authority.

3. He’s convicted of felony or any office involving dishonesty or fraud

4. He has been convicted of drug offenses

5. Any of his parents has defaulted in respect of student’s loan or any loan granted to him or her.

For repayment of the loan:

1. Any beneficiary of the loan shall commence repayment two years after completion of NYSC

2. Repayment shall be by direct deduction of 10% of the beneficiaries salary at source by that employer and credited to the students loan account.

Headline

Fagbemi warns against obstructing EFCC from performing its lawful duty

The Minister of Justice, Lateef Fagbemi, SAN has warned against obstructing the Economic and Financial Crimes Commission (EFCC) from carrying out its lawful duty .

Fagbemi’s warning is contained in a statement in Abuja.

“This is a matter of very grave concern, it is now beyond doubt that the EFCC is given power by the law to invite any person of interest to interact with them in the course of their investigations into any matter, regardless of status.

“Therefore, the least that we can all do when invited, is not to put any obstruction in the way of EFCC, but to honourably answer their invitation.

“A situation where public officials who are themselves subject of protection by law enforcement agents will set up a stratagem of obstruction to the civil and commendable efforts of the EFCC to perform its duty is to say the least, insufferably disquieting’’.

He added that running away from the law will not resolve issues at stake but only exacerbate them.

“Nigeria has a vibrant judicial system that is capable of protecting everyone who follows the rule of law in seeking protection.

“I therefore encourage anyone who has been invited by the EFCC or any other agency to immediately toe the path of decency and civility by honouring such invitation instead of embarking on a temporising self-help and escapism.

“This can only put our country in bad light before the rest of the world’’.

He said institutions of state should be allowed to function effectively and efficiently.

“I stand for the rule of law and will promptly call EFCC, and indeed any other agency to order when there is an indication of any transgressions of the fundamental rights of any Nigerian by any of the agencies’’.

NAN reports that the EFCC had on Wednesday warned members of the public that it was a criminal offence to obstruct officers of the Commission from carrying out their lawful duties.

Section 38(2)(a(b) of the EFCC Establishment Act makes it an offence to prevent officers of the Commission from carrying out their lawful duties. Culprits risk a jail term of not less than five years.

The warning , the EFCC said, became necessary against the background of the increasing tendency by persons and groups under investigation by the Commission to take the laws into their hands by recruiting thugs to obstruct lawful operations of the EFCC.

On several occasions, the anti graft agency said, operatives of the Commission have had to exercise utmost restraint in the face of such provocation to avoid a breakdown of law and order.

Headline

Unknown Gunmen Abduct Channelstv Reporter In Port-harcourt

Some unknown gunmen have kidnapped Joshua Rogers, the ChannelsTV reporter in Port-Harcourt, the Rivers State capital.

Politics Nigeria learnt that Rogers was picked up close to his residence at Rumuosi in Port Harcourt and to an unknown destination by the gunmen around 9pm on Thursday, April 11.

The reporter was driving his official ChannelsTV branded car when the hoodlums accosted, pointed a gun at him and took him away in the same vehicle.

Rogers was said to be returning from his official assignment in Government House after a trip to Andoni for a government event when the incident happened.

Already, the gunmen were said to have contacted his wife and demanded a N30million ransom for bis release.

His cameraman confirmed the incident and appealed to his abductors to set him free unconditionally.