Headline

Invite Nnamdi Kanu For Discussion, Ohanaeze Tells Tinubu

Apex Igbo socio-cultural organisation, Ohanaeze Ndigbo Youth Council Worldwide has expressed outrage over the attack on Mazi Nnamdi Kanu, leader of the Indigenous People of Biafra, by ex-militant leader, Mujahid Dokubo-Asari.

So This Happened (202) Reviews Lagos Bizman’s Arraignment Over Wife’s Death, Others | Punch

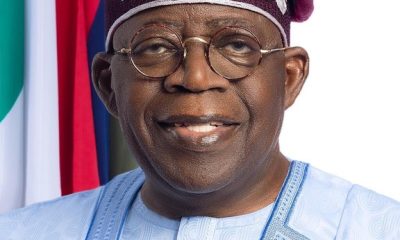

The Igbo group called on President Bola Tinubu to ignore the likes of Dokubo and invite Kanu for a round table discussion.

Dokubo had while speaking to journalists after a meeting with President Tinubu branded the IPOB leader a criminal, calling on Tinubu not to release him.

His statement has continued to draw the anger of Ndigbo, with many accusing him of reaching beyond his bounds.

The President of Ohanaeze Ndigbo Youth Council Worldwide, Mazi Okwu Nnabuike, in a statement in Abuja on Sunday accused Dokubo-Asari of being sponsored by those who want to destabilise President Tinubu’s government.

According to him, it was unthinkable that at a time many patriotic citizens of the country were thinking of ways to unite the country, the ex-militant who postures as a ‘son of the President’ was busy throwing up ideas that would further polarise the country.

We have always known Dokubo-Asari as a rabble-rouser who is not interested in the progress and prosperity of this nation.

“This is a man who had been in the creeks for years sabotaging the country’s economy. We all know what it is to sabotage the economy of a country- what other crime could be more than this?

“But curiously, the same man who claims to have repented, even when his boys are still in the creeks, has the temerity to brand Nnamdi Kanu a criminal.

“When did Asari Dokubo become a court of competent jurisdiction to decide who is a criminal? He has only taken his hatred for Ndigbo too far,” Okwu said.

The Igbo group urged President Tinubu to ignore Dokubo and his ilks “who are not in any way interested in the positive future of the country but their selfish gains.

“Mr President made it clear that he is ready to unite the fragmented country he inherited from the past administration and he has been so much applauded for this.

“We urge Mr President to go ahead and not allow his administration to be derailed by hypocrites like Asari Dokubo who want to feed fat from any form of crisis in the country. Mr President should be wary of him and his sponsors who are enemies of the government.

“The Federal Government should do well to invite and engage Nnamdi Kanu and other agitators. They are fighting for justice and marginalisation. If the government could engage members of Boko Haram who have killed and maimed millions of people, it should not find it hard to engage the agitators.

“Mr President is one of those who vehemently fought in favour of democracy and justice in the past; he should give a listening ear to Nnamdi Kanu,” Okwu said.

Ohanaeze, however, warned Dokubo “to desist from any further attempt to use Nnamdi Kanu’s ordeal to promote his interests.

“Enough is enough, we warn him to henceforth stop using Ndigbo as an avenue to promote his ego. Everyone knows he has personal issues with Nnamdi Kanu.”

Headline

Fagbemi warns against obstructing EFCC from performing its lawful duty

The Minister of Justice, Lateef Fagbemi, SAN has warned against obstructing the Economic and Financial Crimes Commission (EFCC) from carrying out its lawful duty .

Fagbemi’s warning is contained in a statement in Abuja.

“This is a matter of very grave concern, it is now beyond doubt that the EFCC is given power by the law to invite any person of interest to interact with them in the course of their investigations into any matter, regardless of status.

“Therefore, the least that we can all do when invited, is not to put any obstruction in the way of EFCC, but to honourably answer their invitation.

“A situation where public officials who are themselves subject of protection by law enforcement agents will set up a stratagem of obstruction to the civil and commendable efforts of the EFCC to perform its duty is to say the least, insufferably disquieting’’.

He added that running away from the law will not resolve issues at stake but only exacerbate them.

“Nigeria has a vibrant judicial system that is capable of protecting everyone who follows the rule of law in seeking protection.

“I therefore encourage anyone who has been invited by the EFCC or any other agency to immediately toe the path of decency and civility by honouring such invitation instead of embarking on a temporising self-help and escapism.

“This can only put our country in bad light before the rest of the world’’.

He said institutions of state should be allowed to function effectively and efficiently.

“I stand for the rule of law and will promptly call EFCC, and indeed any other agency to order when there is an indication of any transgressions of the fundamental rights of any Nigerian by any of the agencies’’.

NAN reports that the EFCC had on Wednesday warned members of the public that it was a criminal offence to obstruct officers of the Commission from carrying out their lawful duties.

Section 38(2)(a(b) of the EFCC Establishment Act makes it an offence to prevent officers of the Commission from carrying out their lawful duties. Culprits risk a jail term of not less than five years.

The warning , the EFCC said, became necessary against the background of the increasing tendency by persons and groups under investigation by the Commission to take the laws into their hands by recruiting thugs to obstruct lawful operations of the EFCC.

On several occasions, the anti graft agency said, operatives of the Commission have had to exercise utmost restraint in the face of such provocation to avoid a breakdown of law and order.

Headline

Unknown Gunmen Abduct Channelstv Reporter In Port-harcourt

Some unknown gunmen have kidnapped Joshua Rogers, the ChannelsTV reporter in Port-Harcourt, the Rivers State capital.

Politics Nigeria learnt that Rogers was picked up close to his residence at Rumuosi in Port Harcourt and to an unknown destination by the gunmen around 9pm on Thursday, April 11.

The reporter was driving his official ChannelsTV branded car when the hoodlums accosted, pointed a gun at him and took him away in the same vehicle.

Rogers was said to be returning from his official assignment in Government House after a trip to Andoni for a government event when the incident happened.

Already, the gunmen were said to have contacted his wife and demanded a N30million ransom for bis release.

His cameraman confirmed the incident and appealed to his abductors to set him free unconditionally.