Headline

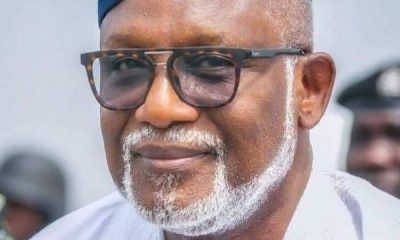

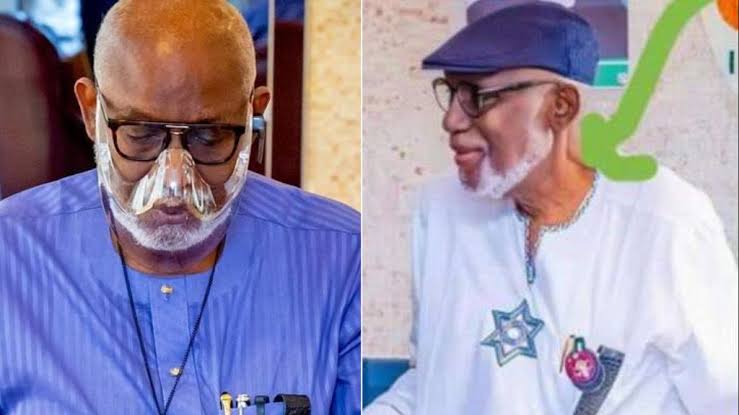

Ondo Govt reacts to Gov Akeredolu’s illness, ability to govern

Ondo state government has countered the national chairman of the All Progressive Congress, Abdullahi Adamu, over claim of Governor Rotimi Akeredolu who is currently on indefinite medical leave abroad, being incapacitated.

Adamu made the claim on Monday, July 10, during a meeting between the national leadership of the party and APC state chairmen in Abuja.

Reacting to this, Ondo state’s commissioner for information and Orientation, Bamidele Ademola-Olateju, stated that the APC national chairman was quoted out of context.

The statement read;

“The attention of Ondo State government has been drawn to a report, credited to the Chairman of the APC, Senator Abdullahi Adamu, in the 11th July, 2023.

“The headline, “Akeredolu in state of extreme incapacity, hospitalised”, bore a tinge of the usual mischievous, wicked and insensitive reportage, sponsored by desperate politicians.

“The Chairman of the APC in Ondo State, Engineer Ade Adetimehin, who attended the meeting, has debunked the report as untrue and totally disconnected from the statement of the Chairman at the event.

“The National Chairman was indeed excited at the reports on the rate of recovery of the Governor of Ondo State, Arakunrin Oluwarotimi Akeredolu, SAN, CON, and urged all those present at the meeting to pray for his quick return.

“It, therefore, smacks of mischief and unabashed abandonment of professional ethics for a reporter to present this gross misrepresentation, a mischievous twist, as news.

“At no time did the Chairman mention that the Governor was in a state of “extreme incapacity”.

“He is, evidently, not in any critical state that should warrant this clearly reprehensible conduct as he still sent a post to the Executive Council Committee platform yesterday.

“Members of the public are advised to ignore this news as the contents therein exist in the realm of the imagination of workers of iniquity.

“Mr. Governor is NOT incapacitated. He will return to his duty as soon as the doctors certify him fully fit to do so.”

Headline

Fagbemi warns against obstructing EFCC from performing its lawful duty

The Minister of Justice, Lateef Fagbemi, SAN has warned against obstructing the Economic and Financial Crimes Commission (EFCC) from carrying out its lawful duty .

Fagbemi’s warning is contained in a statement in Abuja.

“This is a matter of very grave concern, it is now beyond doubt that the EFCC is given power by the law to invite any person of interest to interact with them in the course of their investigations into any matter, regardless of status.

“Therefore, the least that we can all do when invited, is not to put any obstruction in the way of EFCC, but to honourably answer their invitation.

“A situation where public officials who are themselves subject of protection by law enforcement agents will set up a stratagem of obstruction to the civil and commendable efforts of the EFCC to perform its duty is to say the least, insufferably disquieting’’.

He added that running away from the law will not resolve issues at stake but only exacerbate them.

“Nigeria has a vibrant judicial system that is capable of protecting everyone who follows the rule of law in seeking protection.

“I therefore encourage anyone who has been invited by the EFCC or any other agency to immediately toe the path of decency and civility by honouring such invitation instead of embarking on a temporising self-help and escapism.

“This can only put our country in bad light before the rest of the world’’.

He said institutions of state should be allowed to function effectively and efficiently.

“I stand for the rule of law and will promptly call EFCC, and indeed any other agency to order when there is an indication of any transgressions of the fundamental rights of any Nigerian by any of the agencies’’.

NAN reports that the EFCC had on Wednesday warned members of the public that it was a criminal offence to obstruct officers of the Commission from carrying out their lawful duties.

Section 38(2)(a(b) of the EFCC Establishment Act makes it an offence to prevent officers of the Commission from carrying out their lawful duties. Culprits risk a jail term of not less than five years.

The warning , the EFCC said, became necessary against the background of the increasing tendency by persons and groups under investigation by the Commission to take the laws into their hands by recruiting thugs to obstruct lawful operations of the EFCC.

On several occasions, the anti graft agency said, operatives of the Commission have had to exercise utmost restraint in the face of such provocation to avoid a breakdown of law and order.

Headline

Unknown Gunmen Abduct Channelstv Reporter In Port-harcourt

Some unknown gunmen have kidnapped Joshua Rogers, the ChannelsTV reporter in Port-Harcourt, the Rivers State capital.

Politics Nigeria learnt that Rogers was picked up close to his residence at Rumuosi in Port Harcourt and to an unknown destination by the gunmen around 9pm on Thursday, April 11.

The reporter was driving his official ChannelsTV branded car when the hoodlums accosted, pointed a gun at him and took him away in the same vehicle.

Rogers was said to be returning from his official assignment in Government House after a trip to Andoni for a government event when the incident happened.

Already, the gunmen were said to have contacted his wife and demanded a N30million ransom for bis release.

His cameraman confirmed the incident and appealed to his abductors to set him free unconditionally.

-

Business5 days ago

Business5 days agoSeplat Energy celebrates a decade of Dual Listing with Bell Ringing Ceremony at Nigerian Stock Exchange

-

News5 days ago

News5 days agoBDCs now buying dollar at ₦980 — ABCON President

-

Metro5 days ago

Metro5 days agoOsun Poly Student, Olanrewaju Olatona killed by hit-and-run one-way driver

-

Headline5 days ago

Headline5 days agoFagbemi warns against obstructing EFCC from performing its lawful duty

-

News5 days ago

News5 days agoLASG’s maize palliative impactful, says poultry association chair

-

News5 days ago

News5 days agoWoman killed while crossing road in Anambra