Headline

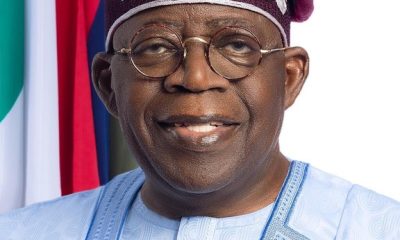

NLC Protests Tinubu’s N500bn Subsidy Palliative, Demands 300% Pay Rise

The Nigeria Labour Congress and the Trade Union Congress have thumbed down the N500bn palliative proposed by President Bola Tinubu, stating that it is grossly inadequate to assuage the hardships confronting workers sequel to the fuel subsidy removal.

They are demanding a 300 per cent salary increase to enable workers to cope with the challenges imposed by the deteriorating economic situation that came with the removal of the controversial fuel subsidy.

On Wednesday, the President wrote to the House of Representatives seeking approval for N500bn to cushion the effects of petrol subsidy removal.

Tinubu’s request was contained in a letter sent to the National Assembly and read during plenary by the Speaker of the House of Representatives, Tajudeen Abbas.

The President had announced the petrol subsidy removal during his inaugural address on May 29, 2023, in response to claims that the subsidy regime favoured the rich more than the average Nigerians, among other reasons.

In his letter, the President proposed an amendment to the 2022 Supplementary Appropriation Act.

It read, “I write to the House of Reps to approve the amendment of the 2022 Supplementary Appropriation Act in accordance with the attached.

“The request has become necessarily important to, among other things, the source for funds necessary to provide palliatives to mitigate the effect of the removal of fuel subsidy on Nigerians.

“Thus, the sum of N500bn only has been extracted from the 2022 Supplementary Act of N819,536,937,815 for the provision of palliative to cushion the effect of petrol subsidy removal.”

The president said he hoped the lawmakers would consider his request “expeditiously.”

The House is expected to hold a plenary today on the president’s request.

Last December, the National Assembly passed a supplementary budget of N819bn for the 2022 fiscal year and also extended the implementation of the 2022 budget till March 31, 2023.

In May, the National Assembly passed the amendment to the 2022 supplementary budget to extend the implementation of the capital components to December 2023.

But unimpressed by the amount contained in the President’s letter, the NLC noted that the money would not be enough to cater for 125 million Nigerians who are believed to be living in poverty.

The National Treasurer of the NLC, Hakeem Ambali, who spoke in an interview with our correspondent in Abuja, questioned the extent to which the palliative would cover.

When asked if the amount would be sufficient, he said, “Definitely not. We have over 125m Nigerians that are technically poor. To what extent can this cushion the effects of this economic hardship?”

Speaking on ways by which the President can mitigate the effect of subsidy removal, the NLC official asked for “Minimum wage review of 300 per cent to all workers; granting licences to individuals for modular refineries to refine petrol locally; granting economic stimulus loan to SMEs at 15 per cent rate.’’

He added, ‘’The government should provide social benefits for aged and unemployed youths; agric loans to farmers and youths through the Agric Bank and community banks at single digit rate; provide alternative energy supply such as massive investment in solar power and Compressed Natural Gas to motorists.

“Fix the refineries; reverse the privatization of electricity back to the state due to poor performance; Execute metro rail line projects in all state capitals and reduction of school fees for students of tertiary institutions.”

NACCIMA, LCCI react

Speaking with The PUNCH, the Director-General of the Nigerian Association of Chambers of Commerce, Industry, Mines and Agriculture, Olusola Obadimu, welcomed the idea of palliatives for the poor, but he questioned how the N500bn for the palliative measures would be spent.

According to him, the chamber will refrain from making further comments on the matter until clarification is given on how the fund would be utilised.

He said, “The idea, in principle, is good. Of course, people expect some relief. It is in the statement that we issued. We said it clearly that palliatives would be a good idea. We argued for it. But talking about a specific figure is something we can’t do when we don’t know the scope. The concept is fine, but we need more information about the scope.”

On his part, the Deputy-President of the Lagos Chamber of Commerce and Industry, Gabriel Idahosa, while commending the move, said the fund would be insufficient to cushion the impact of the subsidy removal and the devaluation of the naira.

He further stated that the media and other interest groups must sustain the advocacy to ensure that the palliative measures are extended to the public and private sectors.

Idahosa said, “Whatever the president implements will not be sufficient to wipe out the impact of the two policies — subsidy removal and floating of the currency. So, it is going to be a partial effort to reduce, not eliminate the effect of those policies.

“There is a basis to complain if the details come out and only the public (sector) gets to benefit from it, then everybody in the private sector has a reason to complain. We have to wait and see how the first set of palliatives will be designed, then we can complain legitimately if the private sector is not involved.”

The President of the Nigerian Economic Summit Group, Mr Laoye Jaiyeola, said his group supported the palliative measure but stressed that it should be extended to those who really needed it.

He stated, “The clarity is that all of us are saying we must have palliative for the people affected. So if you are asking for palliative and the president cannot spend one naira without approval; so, where can he get it if he doesn’t borrow it?

‘’Everyone said there must be palliative for the subsidy removal and the palliative means that government must address the shock of the people. You know you cannot spend without approval and you also know that we are in deficit before; so, which other way can he get money if not borrow? So, he is following what the procedure says is legal.

“We support palliatives but it should go to the ultimate consumer and not those who sit in one place and are spending money. Identify the people that were affected the most and give them the palliative.”

Headline

Fagbemi warns against obstructing EFCC from performing its lawful duty

The Minister of Justice, Lateef Fagbemi, SAN has warned against obstructing the Economic and Financial Crimes Commission (EFCC) from carrying out its lawful duty .

Fagbemi’s warning is contained in a statement in Abuja.

“This is a matter of very grave concern, it is now beyond doubt that the EFCC is given power by the law to invite any person of interest to interact with them in the course of their investigations into any matter, regardless of status.

“Therefore, the least that we can all do when invited, is not to put any obstruction in the way of EFCC, but to honourably answer their invitation.

“A situation where public officials who are themselves subject of protection by law enforcement agents will set up a stratagem of obstruction to the civil and commendable efforts of the EFCC to perform its duty is to say the least, insufferably disquieting’’.

He added that running away from the law will not resolve issues at stake but only exacerbate them.

“Nigeria has a vibrant judicial system that is capable of protecting everyone who follows the rule of law in seeking protection.

“I therefore encourage anyone who has been invited by the EFCC or any other agency to immediately toe the path of decency and civility by honouring such invitation instead of embarking on a temporising self-help and escapism.

“This can only put our country in bad light before the rest of the world’’.

He said institutions of state should be allowed to function effectively and efficiently.

“I stand for the rule of law and will promptly call EFCC, and indeed any other agency to order when there is an indication of any transgressions of the fundamental rights of any Nigerian by any of the agencies’’.

NAN reports that the EFCC had on Wednesday warned members of the public that it was a criminal offence to obstruct officers of the Commission from carrying out their lawful duties.

Section 38(2)(a(b) of the EFCC Establishment Act makes it an offence to prevent officers of the Commission from carrying out their lawful duties. Culprits risk a jail term of not less than five years.

The warning , the EFCC said, became necessary against the background of the increasing tendency by persons and groups under investigation by the Commission to take the laws into their hands by recruiting thugs to obstruct lawful operations of the EFCC.

On several occasions, the anti graft agency said, operatives of the Commission have had to exercise utmost restraint in the face of such provocation to avoid a breakdown of law and order.

Headline

Unknown Gunmen Abduct Channelstv Reporter In Port-harcourt

Some unknown gunmen have kidnapped Joshua Rogers, the ChannelsTV reporter in Port-Harcourt, the Rivers State capital.

Politics Nigeria learnt that Rogers was picked up close to his residence at Rumuosi in Port Harcourt and to an unknown destination by the gunmen around 9pm on Thursday, April 11.

The reporter was driving his official ChannelsTV branded car when the hoodlums accosted, pointed a gun at him and took him away in the same vehicle.

Rogers was said to be returning from his official assignment in Government House after a trip to Andoni for a government event when the incident happened.

Already, the gunmen were said to have contacted his wife and demanded a N30million ransom for bis release.

His cameraman confirmed the incident and appealed to his abductors to set him free unconditionally.