Headline

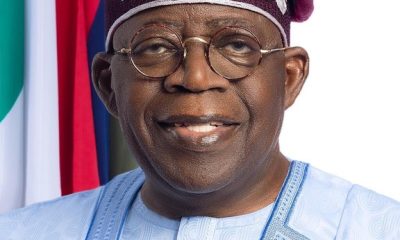

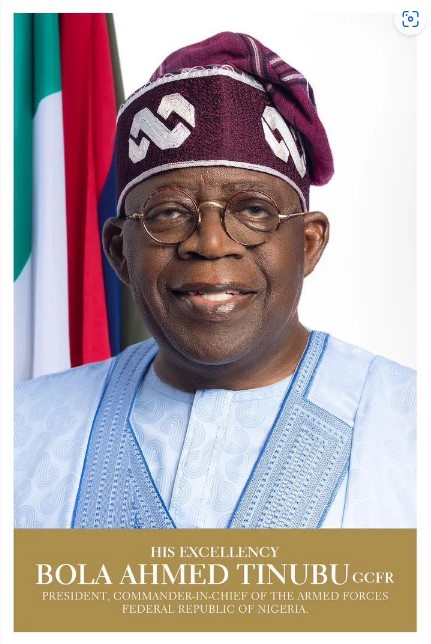

NASS To Receive List Of Tinubu’s Ministerial Nominees Tomorrow

Barring any last minute change, President Bola Tinubu is expected to send the list of ministerial nominees to the Senate for screening this week.

The President is expected, by law, to forward the list of ministerial nominees to the National Assembly 60 days from the date he takes the oath of office.

The administration of Tinubu was inaugurated on May 29, when the former President Muhammadu Buhari handed over the mantle of leadership to him.

Going by the constitutional provision of the 60 days, the President is left with about 10 days to constitute his cabinet.

Presidency sources hinted that the list of ministerial nominees has been prepared for a long time but there have been adjustments in the list.

A Presidency source, who spoke on the condition of anonymity, said: “The list of ministerial nominees has been ready since but the President has made some changes in some states.

“The list is expected to be forwarded to the National Assembly between Wednesday and Thursday except there is any development that could delay it again further.

“The President is supposed to constitute his cabinet latest July 26. So, I am sure that the list will be sent to the senate this week.”

Recall that different purported ministerial lists have been in circulation as the President keeps Nigerians guessing on who would make the list and whether there will be government of national unity as speculated in some quarters.

The presidential spokesman, Mr Dele Alake, recently said that it is only President Tinubu that could decide when to submit the list of the nominees to the National Assembly as well as those to make the list.

Alake assured that the list will be made public before the expiration of the 60 days.

Headline

Fagbemi warns against obstructing EFCC from performing its lawful duty

The Minister of Justice, Lateef Fagbemi, SAN has warned against obstructing the Economic and Financial Crimes Commission (EFCC) from carrying out its lawful duty .

Fagbemi’s warning is contained in a statement in Abuja.

“This is a matter of very grave concern, it is now beyond doubt that the EFCC is given power by the law to invite any person of interest to interact with them in the course of their investigations into any matter, regardless of status.

“Therefore, the least that we can all do when invited, is not to put any obstruction in the way of EFCC, but to honourably answer their invitation.

“A situation where public officials who are themselves subject of protection by law enforcement agents will set up a stratagem of obstruction to the civil and commendable efforts of the EFCC to perform its duty is to say the least, insufferably disquieting’’.

He added that running away from the law will not resolve issues at stake but only exacerbate them.

“Nigeria has a vibrant judicial system that is capable of protecting everyone who follows the rule of law in seeking protection.

“I therefore encourage anyone who has been invited by the EFCC or any other agency to immediately toe the path of decency and civility by honouring such invitation instead of embarking on a temporising self-help and escapism.

“This can only put our country in bad light before the rest of the world’’.

He said institutions of state should be allowed to function effectively and efficiently.

“I stand for the rule of law and will promptly call EFCC, and indeed any other agency to order when there is an indication of any transgressions of the fundamental rights of any Nigerian by any of the agencies’’.

NAN reports that the EFCC had on Wednesday warned members of the public that it was a criminal offence to obstruct officers of the Commission from carrying out their lawful duties.

Section 38(2)(a(b) of the EFCC Establishment Act makes it an offence to prevent officers of the Commission from carrying out their lawful duties. Culprits risk a jail term of not less than five years.

The warning , the EFCC said, became necessary against the background of the increasing tendency by persons and groups under investigation by the Commission to take the laws into their hands by recruiting thugs to obstruct lawful operations of the EFCC.

On several occasions, the anti graft agency said, operatives of the Commission have had to exercise utmost restraint in the face of such provocation to avoid a breakdown of law and order.

Headline

Unknown Gunmen Abduct Channelstv Reporter In Port-harcourt

Some unknown gunmen have kidnapped Joshua Rogers, the ChannelsTV reporter in Port-Harcourt, the Rivers State capital.

Politics Nigeria learnt that Rogers was picked up close to his residence at Rumuosi in Port Harcourt and to an unknown destination by the gunmen around 9pm on Thursday, April 11.

The reporter was driving his official ChannelsTV branded car when the hoodlums accosted, pointed a gun at him and took him away in the same vehicle.

Rogers was said to be returning from his official assignment in Government House after a trip to Andoni for a government event when the incident happened.

Already, the gunmen were said to have contacted his wife and demanded a N30million ransom for bis release.

His cameraman confirmed the incident and appealed to his abductors to set him free unconditionally.