Headline

Ministerial list: New ministries may be created – CoS Gbajabiamila

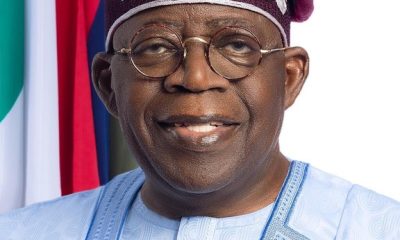

The President Bola Tinubu’s administration may create new ministries from the existing ones, Femi Gbajabiamila, Chief of Staff to the President, disclosed on Thursday in Abuja.

The ministerial list was submitted to the National Assembly today by Gbajabiamila and was read by Senate President Godswill Akpabio.

‘’Mr President intends to separate portfolios or restructure the ministries in such a way you might be hearing of new ministries that were not standalone ministries before. So the process continues.’’

The 28 minister-nominees include Abubakar Momoh, Yusuf Maitama Tuggar, Ahmed Dangiwa, Hannatu Musawa, Chief Uche Nnaji, Dr Betta Edu, Dr Doris Aniche Uzoka, David Umahi, and Nyesom Wike.

Others are Badaru Abubakar, Nasiru Ahmed El-Rufai, Ekperipe Ekpo, Nkeiruka Onyejocha, Olubunmi Tunji Ojo, Stella Okotette, Uju Kennedy Ohaneye, Mr Bello Muhammad Goronyo, Mr Dele Alake, and Mr Lateef Fagbemi.

The rest include Mr Muhammad Idris, Mr Olawale Edun, Mr Waheed Adebayo Adelabu, Mrs Iman Suleiman Ibrahim, Prof. Ali Pate, Prof. Joseph Utsev, Sen. Abubakar Kyari, Sen. John Enoh, and Sen. Sani Abubakar Danladi.

Gbajabiamila said that the nominees were chosen after undergoing strict personal screening by the President.

He said that a second part comprising 13 names would be sent to the assembly, adding that this was part of the process of having a cabinet for the administration.

‘’As you know he had 60 days from time of inauguration, as stipulated in the constitution. He has fulfilled that requirement of the constitution by submitting 28 names today.

‘’As his letter stated, and was read on the floor of the Senate, the remaining names, not sure how many, probably about 12, maybe 13, will be forwarded to the Senate in the coming days.

‘’As far as the nominees themselves are concerned, and like I said, Mr President took his time to sift through those names,’’ he said.

The Chief of Staff said that the president decided to tow the line of tradition by not attaching the portfolio of the nominees in the letter to the senate in order to give room for reviews.

‘’As good as that sounds, it straitjackets the president to pigeonhole one person in an office or the other. What happens then if you change your mind, do you then bring the person back for screening again, because the president is at liberty to change your mind.

‘’For instance, if I decide I want somebody as Minister of Labour, and then after sending the name, later on, I decide that this person would actually be better with another portfolio. And meanwhile, the Senate has screened that person for that particular initial portfolio?.

‘’What happens then? Do you now re-screen the person? So, a lot of these things have their merits and demerits,’’ Gbajabiamila said.

Headline

Fagbemi warns against obstructing EFCC from performing its lawful duty

The Minister of Justice, Lateef Fagbemi, SAN has warned against obstructing the Economic and Financial Crimes Commission (EFCC) from carrying out its lawful duty .

Fagbemi’s warning is contained in a statement in Abuja.

“This is a matter of very grave concern, it is now beyond doubt that the EFCC is given power by the law to invite any person of interest to interact with them in the course of their investigations into any matter, regardless of status.

“Therefore, the least that we can all do when invited, is not to put any obstruction in the way of EFCC, but to honourably answer their invitation.

“A situation where public officials who are themselves subject of protection by law enforcement agents will set up a stratagem of obstruction to the civil and commendable efforts of the EFCC to perform its duty is to say the least, insufferably disquieting’’.

He added that running away from the law will not resolve issues at stake but only exacerbate them.

“Nigeria has a vibrant judicial system that is capable of protecting everyone who follows the rule of law in seeking protection.

“I therefore encourage anyone who has been invited by the EFCC or any other agency to immediately toe the path of decency and civility by honouring such invitation instead of embarking on a temporising self-help and escapism.

“This can only put our country in bad light before the rest of the world’’.

He said institutions of state should be allowed to function effectively and efficiently.

“I stand for the rule of law and will promptly call EFCC, and indeed any other agency to order when there is an indication of any transgressions of the fundamental rights of any Nigerian by any of the agencies’’.

NAN reports that the EFCC had on Wednesday warned members of the public that it was a criminal offence to obstruct officers of the Commission from carrying out their lawful duties.

Section 38(2)(a(b) of the EFCC Establishment Act makes it an offence to prevent officers of the Commission from carrying out their lawful duties. Culprits risk a jail term of not less than five years.

The warning , the EFCC said, became necessary against the background of the increasing tendency by persons and groups under investigation by the Commission to take the laws into their hands by recruiting thugs to obstruct lawful operations of the EFCC.

On several occasions, the anti graft agency said, operatives of the Commission have had to exercise utmost restraint in the face of such provocation to avoid a breakdown of law and order.

Headline

Unknown Gunmen Abduct Channelstv Reporter In Port-harcourt

Some unknown gunmen have kidnapped Joshua Rogers, the ChannelsTV reporter in Port-Harcourt, the Rivers State capital.

Politics Nigeria learnt that Rogers was picked up close to his residence at Rumuosi in Port Harcourt and to an unknown destination by the gunmen around 9pm on Thursday, April 11.

The reporter was driving his official ChannelsTV branded car when the hoodlums accosted, pointed a gun at him and took him away in the same vehicle.

Rogers was said to be returning from his official assignment in Government House after a trip to Andoni for a government event when the incident happened.

Already, the gunmen were said to have contacted his wife and demanded a N30million ransom for bis release.

His cameraman confirmed the incident and appealed to his abductors to set him free unconditionally.