Headline

Ondo State announces 30-year infrastructure development plan

Ondo State government announced a 30-year development plan, “Ondo 2054’’ in Akure on Sunday.

Commissioner for Economic Planning and Budget, Mr Emmanuel Igbasan, said the plan, designed in collaboration with the UNDP, was for the infrastructural and socio-economic development of all parts of the state.

He said the state’s House of Assembly would legislate over the plan to give it legal backing.

“As a people, we must define a clear path for our progress.

“For a nation to experience progress and development, there must be a clear, strategic and sustainable trajectory, which provides the compass to guide and direct efforts and resources.

“The future we all desire depends on the vision we have; the strength of the foundation we lay and the efforts we make today.

“It is, therefore, against this realisation that the present administration, in compliance with the provisions of the Fiscal Responsibility Law 2017, started the process of charting a clear path.

“The path will address our present day challenges and provide the highway for accelerated development for the next 30 years.

“The core objective of this exercise is to galvanise all citizens and friends of Ondo State to collectively set the policy direction that will optimise our efforts and harness our potentials.

“It is to define the future we want and to channel our energies to catalyse the socio-economic activities that will guarantee a shared prosperity for all, irrespective of the party in power,’’ he said.

Igbasan stressed that Ondo State needed the long-term development plan also for the adequate and accelerated exploration of the natural resources in its 18 local government areas.

“Our development and technical partner, the UNDP, assisted us in conducting the needs assessment throughout the 18 local government areas and trained our technical staff on system dynamics approach.

“Ondo State is ranked as the 7th biggest economy in Nigeria.

“It has tremendous potential to be the giant of Nigeria as the highest producer of cocoa; the largest deposit of bitumen and boasts of arable and fertile land with various vegetation.

“The state is blessed with gold, oil and gas, granite, silica and ceramics, but most essentially it is populated with about six million intelligent, honest and industrious people,’’ the commissioner said.

Igbasan said government would establish a steering committee with which residents and investors could liaise to actualise the project.

Headline

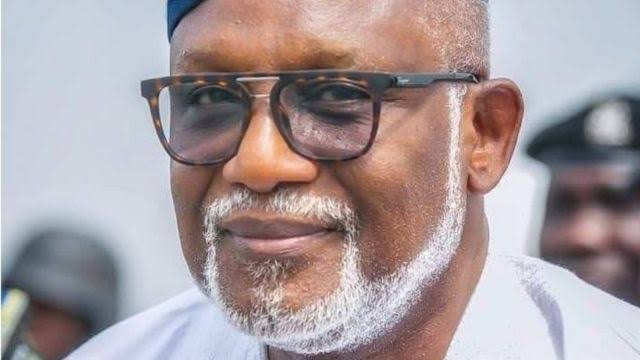

Fagbemi warns against obstructing EFCC from performing its lawful duty

The Minister of Justice, Lateef Fagbemi, SAN has warned against obstructing the Economic and Financial Crimes Commission (EFCC) from carrying out its lawful duty .

Fagbemi’s warning is contained in a statement in Abuja.

“This is a matter of very grave concern, it is now beyond doubt that the EFCC is given power by the law to invite any person of interest to interact with them in the course of their investigations into any matter, regardless of status.

“Therefore, the least that we can all do when invited, is not to put any obstruction in the way of EFCC, but to honourably answer their invitation.

“A situation where public officials who are themselves subject of protection by law enforcement agents will set up a stratagem of obstruction to the civil and commendable efforts of the EFCC to perform its duty is to say the least, insufferably disquieting’’.

He added that running away from the law will not resolve issues at stake but only exacerbate them.

“Nigeria has a vibrant judicial system that is capable of protecting everyone who follows the rule of law in seeking protection.

“I therefore encourage anyone who has been invited by the EFCC or any other agency to immediately toe the path of decency and civility by honouring such invitation instead of embarking on a temporising self-help and escapism.

“This can only put our country in bad light before the rest of the world’’.

He said institutions of state should be allowed to function effectively and efficiently.

“I stand for the rule of law and will promptly call EFCC, and indeed any other agency to order when there is an indication of any transgressions of the fundamental rights of any Nigerian by any of the agencies’’.

NAN reports that the EFCC had on Wednesday warned members of the public that it was a criminal offence to obstruct officers of the Commission from carrying out their lawful duties.

Section 38(2)(a(b) of the EFCC Establishment Act makes it an offence to prevent officers of the Commission from carrying out their lawful duties. Culprits risk a jail term of not less than five years.

The warning , the EFCC said, became necessary against the background of the increasing tendency by persons and groups under investigation by the Commission to take the laws into their hands by recruiting thugs to obstruct lawful operations of the EFCC.

On several occasions, the anti graft agency said, operatives of the Commission have had to exercise utmost restraint in the face of such provocation to avoid a breakdown of law and order.

Headline

Unknown Gunmen Abduct Channelstv Reporter In Port-harcourt

Some unknown gunmen have kidnapped Joshua Rogers, the ChannelsTV reporter in Port-Harcourt, the Rivers State capital.

Politics Nigeria learnt that Rogers was picked up close to his residence at Rumuosi in Port Harcourt and to an unknown destination by the gunmen around 9pm on Thursday, April 11.

The reporter was driving his official ChannelsTV branded car when the hoodlums accosted, pointed a gun at him and took him away in the same vehicle.

Rogers was said to be returning from his official assignment in Government House after a trip to Andoni for a government event when the incident happened.

Already, the gunmen were said to have contacted his wife and demanded a N30million ransom for bis release.

His cameraman confirmed the incident and appealed to his abductors to set him free unconditionally.

-

Business5 days ago

Business5 days agoSeplat Energy celebrates a decade of Dual Listing with Bell Ringing Ceremony at Nigerian Stock Exchange

-

News5 days ago

News5 days agoBDCs now buying dollar at ₦980 — ABCON President

-

Metro5 days ago

Metro5 days agoOsun Poly Student, Olanrewaju Olatona killed by hit-and-run one-way driver

-

Headline5 days ago

Headline5 days agoFagbemi warns against obstructing EFCC from performing its lawful duty

-

News5 days ago

News5 days agoLASG’s maize palliative impactful, says poultry association chair

-

News5 days ago

News5 days agoWoman killed while crossing road in Anambra