News

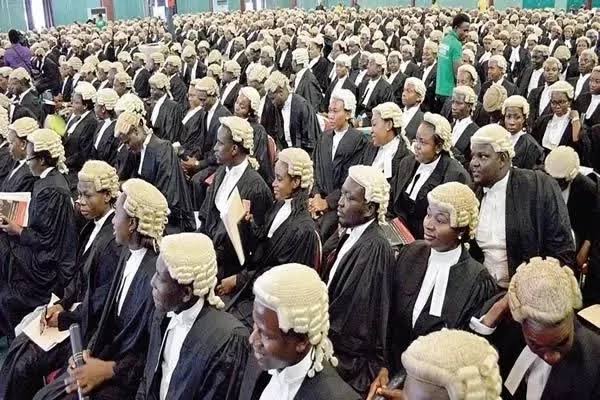

Anti-graft war: Kaduna NBA pledges support to EFCC

The Kaduna State Branch of the Nigerian Bar Association (NBA) has pledged its support and assistance to the Economic and Financial Crimes Commission (EFCC) in furtherance of the fight against corruption in Nigeria.

Its spokesperson, Wilson Uwujaren said this in a statement in Abuja on Thursday.

Godwin Ochai, Chairman of the branch, stated this on Thursday, Aug. 10, during a visit to the Kaduna Zonal Command of the EFCC.

According to him, the EFCC and the NBA are partners in progress as far as the fight against corruption is concerned

He also commended the Legal and Prosecution Department of the command for the co-operation received so far.

He further stated that the visit was to strengthen the existing relationship between the EFCC and the NBA in the fight against corruption.

In response, the Acting Commander, Kaduna Zonal Command of the EFCC, ACE I Aisha Abubakar expressed appreciation for the visit.

Abubakar solicited more synergy and support of NBA in advancing the good work of the EFCC toward eradicating economic and financial crimes including corruption.

She urged NBA to always verify claims made by their clients and members against the EFCC in order not to be misled.

Head Legal and Prosecution, ACE I, Nasiru Salele, also thanked the branch for the visit, saying it was the first of its kind in the command.

News

Woman killed while crossing road in Anambra

The Federal Road Safety Corps (FRSC), Anambra State Sector Command, has confirmed the death of a woman in an accident at Okpoko Market on the Asaba-Onitsha Road.

The Sector Commander, Mr Adeoye Irelewuyi, who confirmed the accident to journalists in Awka on Thursday, said that the woman was hit while she was crossing the road.

He said that the accident, which occurred on Wednesday, involved a commercial tow truck with registration number XA550BMA.

“Eyewitness report reaching us indicates that the truck was towing a vehicle in an uncontrollable speed along the axis.

“The vehicle that was being towed got detached from the tow truck.

“It hit and killed a female adult, who was said to be crossing the road, while the tow truck continued its movement.

“FRSC rescue team came to the scene and took the woman to Toronto Hospital, Onitsha, where she was confirmed dead and her body deposited at the hospital’s mortuary,” he said.

While sympathising with the family of the dead, the sector commander urged motorists, especially tow truck drivers, to exercise a high level of professionalism.

He also urged the drivers to always use standard equipment and avoid speeding.

News

LASG’s maize palliative impactful, says poultry association chair

The Chairman, Poultry Association of Nigeria (PAN), Lagos State Chapter, Mr Mojeed Iyiola, said the state government’s maize palliative to members of the association made a positive impact on the sector.

Iyiola said this in an interview with the News Agency of Nigeria (NAN) on Thursday in Lagos.

“We received about 150,000 tons of maize in February from the Lagos State government as palliative to cushion the effect of high feed prices.

“The major benefit of the palliative is that it actually cushioned the cost of production for most poultry farmers in the state.

“The palliative was beneficial as it made the cost of some poultry produce, especially eggs to drop,” Iyiola said.

He noted that prior to the palliative, a crate of egg was sold between N3,500 and N3,700 at the farm gate, but after the palliative, it now sells between N3,200 and N3,400.

According to the PAN chair, retailers and middlemen who sell from N3,800 to N4,200 do that for their personal gain.

“We have urged our members to sell their eggs at reasonable prices following the receipt of the palliative from the government.

“We appreciate the Lagos State government for the palliative but we also urge the federal government to do likewise, to further reduce the cost of production in the sector.

“This will consequently lead to drop in the prices of all poultry produce across board,” he said.

He said the palliative was shared among financial members of the association at no extra cost.

“As an association we shared the grains equally across PAN’s eight zones in the state equally. We also mandated each zone not the sell even a grain of the maize.

“We, however, considered new poultry farmers who wanted to the join the association as beneficiaries of the palliative,” said Iyiola.

He noted that through the palliative, more poultry farmers were recruited into the association.

“The maize was shared only to poultry farmers and not feed millers, it is the major component of poultry feed formulation,” he said.