Headline

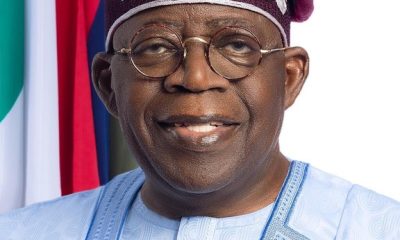

Tinubu endorses Heritage Voyage Initiative

President Bola Tinubu has thrown his weight behind the ‘Heritage Voyage of Return Initiative’, aimed at reuniting African descendants with their African roots.

Tinubu said the initiative would not only re-awaken the historical awareness of society by bringing back memories of what happened many years ago but also create economic benefits.

The president spoke when he received a delegation from Nobel Laureate Prof. Wole Soyinka along with the initiators of the project in Abuja on Friday.

“Reconnecting Afro-Brazilians with their African roots will be an iconic project that will rekindle our past and light up the spirit of our ancestors. It will re-awaken memories of what happened many years ago.

“It is a good thing that this is coming now at a time when we are working on expanding the frontiers of freedom and democracy in Africa,” Tinubu said.

While thanking Soyinka for supporting the initiative and for his commitment and patriotism over the years, the president emphasised that the project would come with economic benefits that must be leveraged, noting that “this is an important project that must be pursued”.

Speaking earlier, Prof. Wale Adeniran, who led the delegation, said that the history of the project dated back to when the Lagos Black Heritage Festival began.

“Because this is an identical project, the initiators of the Heritage Voyage of Return discussed the plan with Prof. Soyinka, who also endorsed it.”

Adeniran described the Heritage Voyage of Return as a historic maritime journey that would begin in Rio de Janeiro in Brazil, making stops at various African nations and terminating in Lagos.

He said that the team had come to seek Tinubu’s endorsement and for him to formally invite the Afro-descendants from Brazil home.

Other members of the delegation are Carolina Maira Morais, a Brazilian and Ajoyemi Olabisi Osunleye, a Nigerian.

Morais noted that there were up to 126 million Afro-descendants in Brazil, stating that the project would be integrating the two nations.

“Nigeria is the largest black nation and the leading economy in Africa and Brazil is a giant in South America.

“There are many African traditional families in Brazil. But no African country has gone to Brazil to identify and connect with them,” she said.

Morais stated that Brazilian President Lula da Silva was planning to visit Nigeria and had a special place in his heart for Africa, describing Soyinka also as a hero and icon in Brazil.

Headline

Fagbemi warns against obstructing EFCC from performing its lawful duty

The Minister of Justice, Lateef Fagbemi, SAN has warned against obstructing the Economic and Financial Crimes Commission (EFCC) from carrying out its lawful duty .

Fagbemi’s warning is contained in a statement in Abuja.

“This is a matter of very grave concern, it is now beyond doubt that the EFCC is given power by the law to invite any person of interest to interact with them in the course of their investigations into any matter, regardless of status.

“Therefore, the least that we can all do when invited, is not to put any obstruction in the way of EFCC, but to honourably answer their invitation.

“A situation where public officials who are themselves subject of protection by law enforcement agents will set up a stratagem of obstruction to the civil and commendable efforts of the EFCC to perform its duty is to say the least, insufferably disquieting’’.

He added that running away from the law will not resolve issues at stake but only exacerbate them.

“Nigeria has a vibrant judicial system that is capable of protecting everyone who follows the rule of law in seeking protection.

“I therefore encourage anyone who has been invited by the EFCC or any other agency to immediately toe the path of decency and civility by honouring such invitation instead of embarking on a temporising self-help and escapism.

“This can only put our country in bad light before the rest of the world’’.

He said institutions of state should be allowed to function effectively and efficiently.

“I stand for the rule of law and will promptly call EFCC, and indeed any other agency to order when there is an indication of any transgressions of the fundamental rights of any Nigerian by any of the agencies’’.

NAN reports that the EFCC had on Wednesday warned members of the public that it was a criminal offence to obstruct officers of the Commission from carrying out their lawful duties.

Section 38(2)(a(b) of the EFCC Establishment Act makes it an offence to prevent officers of the Commission from carrying out their lawful duties. Culprits risk a jail term of not less than five years.

The warning , the EFCC said, became necessary against the background of the increasing tendency by persons and groups under investigation by the Commission to take the laws into their hands by recruiting thugs to obstruct lawful operations of the EFCC.

On several occasions, the anti graft agency said, operatives of the Commission have had to exercise utmost restraint in the face of such provocation to avoid a breakdown of law and order.

Headline

Unknown Gunmen Abduct Channelstv Reporter In Port-harcourt

Some unknown gunmen have kidnapped Joshua Rogers, the ChannelsTV reporter in Port-Harcourt, the Rivers State capital.

Politics Nigeria learnt that Rogers was picked up close to his residence at Rumuosi in Port Harcourt and to an unknown destination by the gunmen around 9pm on Thursday, April 11.

The reporter was driving his official ChannelsTV branded car when the hoodlums accosted, pointed a gun at him and took him away in the same vehicle.

Rogers was said to be returning from his official assignment in Government House after a trip to Andoni for a government event when the incident happened.

Already, the gunmen were said to have contacted his wife and demanded a N30million ransom for bis release.

His cameraman confirmed the incident and appealed to his abductors to set him free unconditionally.