Headline

Health minister pledges quality healthcare delivery to Karu residents

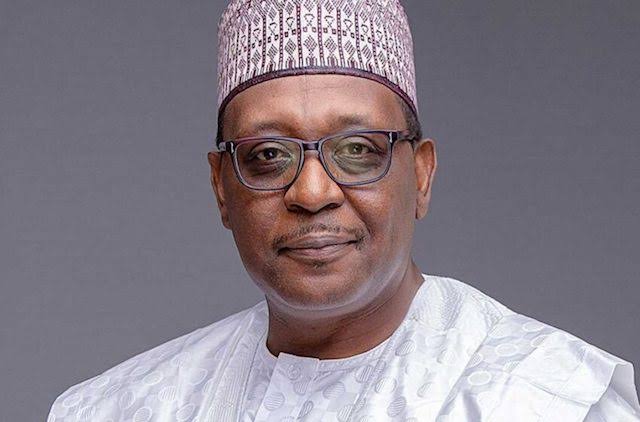

The minister of health, Dr. Muhammad Pate, has pledged support for quality healthcare delivery to Karu residents, in Karu Local Government Area (LGA) of Nasarawa State.

The minister gave the pledge at a “Primary Health Care Development Agency (NPHCDA) Tour” to Karu primary health centre on Thursday, in company of the Chief Executive Officer of Gavi, David Marlow.

Pate said the present administration under the leadership of President Bola Tinubu was committed to improving healthcare to Nigerians.

He admonished Karu residents, irrespective of tribe and state, that the duty of ensuring a healthy living was everyone’s business because disease does not know individual.

The minister said that healthcare was a collaborative effort and as such requires everybody’s cooperation to stay healthy.

Also speaking, Marlow thanked the minister for the warmth welcome into Nigeria to see the good work that the organisation was doing in administering vaccines on children.

Gavi is an international organisation created in 2000 to improve access to new and underused vaccines for children living in the world’s poorest countries.

Marlow urged parents not to forget their task as parents.

He advised them to be responsible, support their children by ensuring they stay healthy as they are the future of the country.

“Make them healthy as they need good health to grow and become something in life,” Marlow said.

He pleaded with the minister to support health workers with education and also provide conducive atmosphere to make their work easier.

The Chairman of Karu, James Thomas, thanked the minister and Marlow for seeing Karu as worthy of their unrelenting support.

He also begged the minister for more health facilities, adding that the available ones are being overstretched.

The Esu Karu, Luka Panya, also a medical personnel (Pharmacist), noted that vaccines over the years have helped children.

Panya urged the minister to keep his promises of delivering good and quality healthcare to Nigerians to ensure improvement in the health sector.

Present at the event include Karu traditional rulers, Gavi Managing Director, Thabani Maphosa, NPHCDA top officials from the Federal and Nasarawa State, among others

Headline

Fagbemi warns against obstructing EFCC from performing its lawful duty

The Minister of Justice, Lateef Fagbemi, SAN has warned against obstructing the Economic and Financial Crimes Commission (EFCC) from carrying out its lawful duty .

Fagbemi’s warning is contained in a statement in Abuja.

“This is a matter of very grave concern, it is now beyond doubt that the EFCC is given power by the law to invite any person of interest to interact with them in the course of their investigations into any matter, regardless of status.

“Therefore, the least that we can all do when invited, is not to put any obstruction in the way of EFCC, but to honourably answer their invitation.

“A situation where public officials who are themselves subject of protection by law enforcement agents will set up a stratagem of obstruction to the civil and commendable efforts of the EFCC to perform its duty is to say the least, insufferably disquieting’’.

He added that running away from the law will not resolve issues at stake but only exacerbate them.

“Nigeria has a vibrant judicial system that is capable of protecting everyone who follows the rule of law in seeking protection.

“I therefore encourage anyone who has been invited by the EFCC or any other agency to immediately toe the path of decency and civility by honouring such invitation instead of embarking on a temporising self-help and escapism.

“This can only put our country in bad light before the rest of the world’’.

He said institutions of state should be allowed to function effectively and efficiently.

“I stand for the rule of law and will promptly call EFCC, and indeed any other agency to order when there is an indication of any transgressions of the fundamental rights of any Nigerian by any of the agencies’’.

NAN reports that the EFCC had on Wednesday warned members of the public that it was a criminal offence to obstruct officers of the Commission from carrying out their lawful duties.

Section 38(2)(a(b) of the EFCC Establishment Act makes it an offence to prevent officers of the Commission from carrying out their lawful duties. Culprits risk a jail term of not less than five years.

The warning , the EFCC said, became necessary against the background of the increasing tendency by persons and groups under investigation by the Commission to take the laws into their hands by recruiting thugs to obstruct lawful operations of the EFCC.

On several occasions, the anti graft agency said, operatives of the Commission have had to exercise utmost restraint in the face of such provocation to avoid a breakdown of law and order.

Headline

Unknown Gunmen Abduct Channelstv Reporter In Port-harcourt

Some unknown gunmen have kidnapped Joshua Rogers, the ChannelsTV reporter in Port-Harcourt, the Rivers State capital.

Politics Nigeria learnt that Rogers was picked up close to his residence at Rumuosi in Port Harcourt and to an unknown destination by the gunmen around 9pm on Thursday, April 11.

The reporter was driving his official ChannelsTV branded car when the hoodlums accosted, pointed a gun at him and took him away in the same vehicle.

Rogers was said to be returning from his official assignment in Government House after a trip to Andoni for a government event when the incident happened.

Already, the gunmen were said to have contacted his wife and demanded a N30million ransom for bis release.

His cameraman confirmed the incident and appealed to his abductors to set him free unconditionally.