Editorial

FG, Come Clean On Nigeria’s Bankruptcy

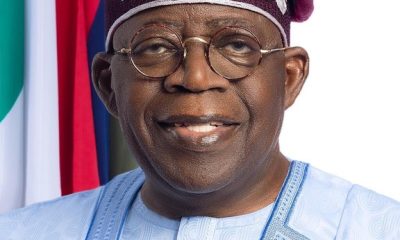

The Presidency created anxiety in Nigeria when, at two separate events last week, it used three economic terminologies that project the aggravated monetary and fiscal crises in the country. The National Security Adviser, Malam Nuhu Ribadu, told the military that the Tinubu government inherited an ‘empty treasury’ and a ‘bankrupt nation.’ President Bola Ahmed Tinubu, on a trip to Saudi Arabia to convince investors to put their money in Nigeria, lamented that his government inherited ‘liabilities’ and some ‘assets,’ but the tone of his speech emphasised more of the liabilities than the assets.

Ribadu was more elaborate on the situation. At the Chief of Defence Intelligence Annual Conference 2023, themed ‘Leveraging Defence Diplomacy and Effective Regional Collaboration for Enhanced National Security’, the NSA said, “We’re facing budgetary constraints. It is okay for me to tell you. Fine, it is important for you to know that we have inherited a very difficult situation; literally a bankrupt country, no money, to a point where we can say that all the money we’re getting now, we’re paying back what was taken. It is serious…”

As an economic concept, a nation that is bankrupt is one that defaults on the repayment of foreign and domestic loans to its creditors. It is not clear if the federal government has defaulted in the repayment of its $113.42 billion debts, but one of its sing-songs has been that over 90 per cent of its revenues have been channelled into debt servicing, i.e., payment of the interest on foreign loans.

The calls are of serious concern because several indicators point to our economic distress. According to economists, there are several symptoms of a government on the verge of bankruptcy. First is the high rate of inflation. In Nigeria, it was put at about 27.3% as of October 2023 and this is not healthy, as it means the purchasing power of the majority of the population is low. Most developed societies maintain a single-digit inflationary rate. Also, a country that faces bankruptcy restricts cash withdrawals from banks, a development that is been observed in parts of the country in recent weeks.

A contemporary example of a country in a similar situation was Greece in 2015, where cash withdrawals were capped at €50 per day. Another sign that a country is inching towards bankruptcy is the devaluation of its national currency. In recent weeks, the value of the naira has plunged so low that, at the official rate, a dollar was exchanged for over N1,000 last week.

Other indicators of bankruptcy include a soaring unemployment rate, the closure of manufacturing industries due to the high cost of forex and the low purchasing power of the populace, the printing of currencies to finance government operations by the Central Bank, the payment of international obligations with revenues from taxes and investment; and an economic condition that makes it difficult for those who used to be well-off, like the middle class, to be out of reach of cash to live on. Nigeria experiences all these at the moment.

Many factors are responsible for bankruptcy, mainly when a nation does not earn enough foreign currency to pay its foreign debts and meet domestic obligations. However, in Nigeria, the current predicament is linked to festering corruption. For instance, the country’s debt profile jumped by 75 per cent in three months—from March 2023 to June 2023—as a result of the securitization of the N22.712 trillion FGN’s Ways and Means Advances by the previous government, according to the Debt Management Office (DMO).

The Tinubu government must not use ‘bankruptcy’ as a prelude to poor economic performance. Many countries emerged great from bankruptcy. Brazil, Mexico, Uruguay, Chile, Costa Rica, Spain and Russia had declared bankruptcy nine times; Germany suffered from bankruptcy eight times in two and a half years; the United States has been bankrupt five times; China and the United Kingdom four times; and even Japan twice.

Instead of lamenting the poor monetary conditions, the Tinubu government must come clean on the level of bankruptcy, investigate what led to it, and probe those who participated in the acts that wrecked the country and bring them to book, not minding whose ox is gored.

While that is being done, we urge the president and his team to work hard and steer the country out of bankruptcy to economic prosperity. There cannot be room for excuses.

It is indeed an irony that the Tinubu government, knowing the state of the economy, asked the National Assembly to approve a supplementary budget of N2.17 trillion, which included renovation of his residence and that of the vice president and even the purchase of vehicles for the First Lady’s office. This is aside from indulging the lawmakers with a N160 million vehicle each. All unnecessary expenditures must stop. For the government to be taken seriously, it must be prudent in its expenditures while implementing measures to improve the lot of Nigerians and the country. These lamentations will not help. Nigerians want to see action, and fast too.

Source: Daily Trust

-

Business6 days ago

Business6 days agoSeplat Energy celebrates a decade of Dual Listing with Bell Ringing Ceremony at Nigerian Stock Exchange

-

News6 days ago

News6 days agoBDCs now buying dollar at ₦980 — ABCON President

-

Metro6 days ago

Metro6 days agoOsun Poly Student, Olanrewaju Olatona killed by hit-and-run one-way driver

-

Headline6 days ago

Headline6 days agoFagbemi warns against obstructing EFCC from performing its lawful duty

-

News6 days ago

News6 days agoLASG’s maize palliative impactful, says poultry association chair

-

News6 days ago

News6 days agoWoman killed while crossing road in Anambra