News

Bank Recapitalisation: Presidency Backs CBN, Investors Rush For Mega-Banks Stock

Presidency on Tuesday expressed support for the banking sector consolidation initiative of the Central Bank of Nigeria, saying it would help the country to grow the economy to a new height.

This came barely five days after the CBN said it would ask banks to raise new capital.

According to the Presidency, it has become important to consider the capital adequacy of Nigerian banks in light of the projected $1tn economy in eight years.

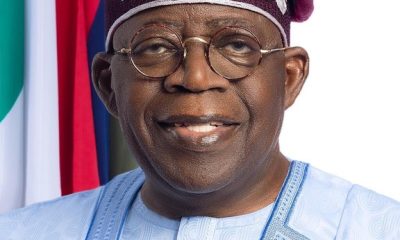

Representing President Bola Tinubu at the 40th Anniversary Celebration of The Guardian Newspapers in Lagos on Tuesday, the President’s Special Adviser on Information and Strategy, Bayo Onanuga, said there would be a strong need to revisit the capital adequacy levels of banks

Onanuga said, “On the economy, that is facing all of us, our ambition to attain the $1tn appears daunting but we believe that it is achievable with God on our side and our collective determine. This explains the reason the VP and I have been on the road trying to attract huge investments into various phases of our economy; agriculture, oil and gas and others.

“To arrive at the $1tn economy, we must address the capital adequacy of our banks that will prepare the fuel for this journey.”

At the 58th annual Bankers’ Dinner last Friday, CBN Governor, Olayemi Cardoso, had said a stress test performed on Nigerian banks revealed that while they would withstand mild to moderate stress, they would be unable to service a $1tn economy projected by Tinubu in seven years, hence the need for recapitalisation.

Cardoso said, “Stress tests conducted on the banking industry also indicate its strength under mild-to-moderate scenarios of sustained economic and financial stress, although there is room for further strengthening and enhancing resilience to shocks. Therefore, there is still much work to be done in fortifying the industry for future challenges.”

He added, “Considering the policy imperatives and the projected economic growth, it is crucial for us to evaluate the adequacy of our banking industry to serve the envisioned larger economy. It is crucial to evaluate the adequacy of our banking industry to serve the envisioned larger economy. It is not just about its current stability. We need to ask ourselves, can Nigerian banks have sufficient capital relative to the finance system needs in servicing a $1tn economy shortly, in my opinion, the answer is no, unless we take action. As a first test, the central bank will be directing banks to increase their capital.”

Mega bank stocks

Meanwhile, PUNCH findings show investors have begun positioning themselves in the stocks of Tier-1 banks listed on the Nigerian Exchange Limited following the announcement of the proposed recapitalisation of the banks.

There are reports some big banks may be eyeing smaller and weaker ones in the event the proposed consolidation in the sector fuels possible acquisitions.

Meanwhile, findings showed that some listed financial institutions gained over N101.18bn on Monday and Tuesday, following the announcement of the proposed banking sector recapitalisation.

An analysis done by The PUNCH at the close of trading on Tuesday revealed that at least six of the lenders added to their market capitalisation in the two trading sessions this week, while five banks shed their value and two remained unchanged.

The lenders who gained included United Bank for Africa Plc, whose market capitalisation rose to N731.87bn on Tuesday from N713.06bn on Friday, the market cap of Zenith Bank Plc appreciated by one per cent to N1.10tn and Access Holdings Plc’s market cap rose by four per cent to close Tuesday’s trading at N639.81bn.

FBN Holdings Plc has been the biggest gainer so far as its market cap stood at N800.47bn on Tuesday from N717.91bn on Friday, marking an 11 per cent appreciation. The market cap of Sterling Financial Holdings Plc rose by 4.51 per cent to N106.81bn and the value of FCMB Group’s share rose by one per cent to N137.63bn.

The five lenders who lost during the period under review include; Guaranty Trust Holding Company (-1 per cent), Jaiz Bank (-2 per cent), Unity Bank (-8.69 per cent), Wema Bank and Stanbic IBTC Holdings (-3.08 per cent) to close with their market capitalisation at N1.13tn, N55.27bn, N19.64bn, N66.61bn and N816.29bn respectively.

The market capitalisation of two lenders, Ecobank Transnational Incorporated Plc and Fidelity Bank remained unchanged over the two-day period at N293.59bn and N288.11bn respectively.

A bank CEO, who earlier spoke to The PUNCH, welcomed the CBN policy direction regarding the recapitalisation of the banks, saying his institution was ready to raise fresh capital though it had yet to conclude the modality.

“Even before the CBN governor made the pronouncement, our bank was already considering raising fresh capital to significantly increase the capital base. This should happen in the first quarter of 2024. So, we are in tune with the CBN governor,” the CEO of a Tier-1 lender told one of our correspondents on Saturday.

In the last few months, First Bank of Nigeria Holdings, Wema Bank and Jaiz Bank have proposed Rights Issues, while Fidelity Bank has announced plans to raise additional capital via the issuance of 13,200 billion ordinary shares via public offer and rights issue. It was gathered that Wema Bank would commence its Rights Issue on December 1.

News

Woman killed while crossing road in Anambra

The Federal Road Safety Corps (FRSC), Anambra State Sector Command, has confirmed the death of a woman in an accident at Okpoko Market on the Asaba-Onitsha Road.

The Sector Commander, Mr Adeoye Irelewuyi, who confirmed the accident to journalists in Awka on Thursday, said that the woman was hit while she was crossing the road.

He said that the accident, which occurred on Wednesday, involved a commercial tow truck with registration number XA550BMA.

“Eyewitness report reaching us indicates that the truck was towing a vehicle in an uncontrollable speed along the axis.

“The vehicle that was being towed got detached from the tow truck.

“It hit and killed a female adult, who was said to be crossing the road, while the tow truck continued its movement.

“FRSC rescue team came to the scene and took the woman to Toronto Hospital, Onitsha, where she was confirmed dead and her body deposited at the hospital’s mortuary,” he said.

While sympathising with the family of the dead, the sector commander urged motorists, especially tow truck drivers, to exercise a high level of professionalism.

He also urged the drivers to always use standard equipment and avoid speeding.

News

LASG’s maize palliative impactful, says poultry association chair

The Chairman, Poultry Association of Nigeria (PAN), Lagos State Chapter, Mr Mojeed Iyiola, said the state government’s maize palliative to members of the association made a positive impact on the sector.

Iyiola said this in an interview with the News Agency of Nigeria (NAN) on Thursday in Lagos.

“We received about 150,000 tons of maize in February from the Lagos State government as palliative to cushion the effect of high feed prices.

“The major benefit of the palliative is that it actually cushioned the cost of production for most poultry farmers in the state.

“The palliative was beneficial as it made the cost of some poultry produce, especially eggs to drop,” Iyiola said.

He noted that prior to the palliative, a crate of egg was sold between N3,500 and N3,700 at the farm gate, but after the palliative, it now sells between N3,200 and N3,400.

According to the PAN chair, retailers and middlemen who sell from N3,800 to N4,200 do that for their personal gain.

“We have urged our members to sell their eggs at reasonable prices following the receipt of the palliative from the government.

“We appreciate the Lagos State government for the palliative but we also urge the federal government to do likewise, to further reduce the cost of production in the sector.

“This will consequently lead to drop in the prices of all poultry produce across board,” he said.

He said the palliative was shared among financial members of the association at no extra cost.

“As an association we shared the grains equally across PAN’s eight zones in the state equally. We also mandated each zone not the sell even a grain of the maize.

“We, however, considered new poultry farmers who wanted to the join the association as beneficiaries of the palliative,” said Iyiola.

He noted that through the palliative, more poultry farmers were recruited into the association.

“The maize was shared only to poultry farmers and not feed millers, it is the major component of poultry feed formulation,” he said.

-

Business4 days ago

Business4 days agoSeplat Energy celebrates a decade of Dual Listing with Bell Ringing Ceremony at Nigerian Stock Exchange

-

News4 days ago

News4 days agoBDCs now buying dollar at ₦980 — ABCON President

-

Metro4 days ago

Metro4 days agoOsun Poly Student, Olanrewaju Olatona killed by hit-and-run one-way driver

-

Headline4 days ago

Headline4 days agoFagbemi warns against obstructing EFCC from performing its lawful duty

-

News4 days ago

News4 days agoLASG’s maize palliative impactful, says poultry association chair

-

News4 days ago

News4 days agoWoman killed while crossing road in Anambra