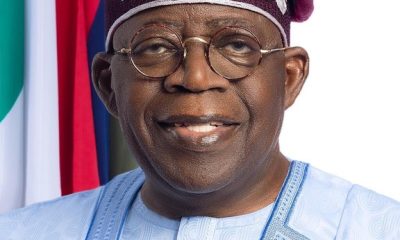

Headline

Tinubu’s Economic Policies Not Living Up To Expectation – Financial Times

London-based Financial Times publication says there are signs of President Bola Tinubu’s economic reforms not going as planned.

In an editorial, the publication noted that although Tinubu started well by removing fuel subsidy and moving towards a market-driven exchange, events in the past four months show that more work has to be done.

“In removing a costly fuel subsidy and in shifting towards a market-driven exchange rate, which has sharply weakened a previously overvalued currency, he has gone some way towards persuading investors he is serious about reform. But four months into his presidency, there are signs of things going awry,” it said.

The report noted that the removal of Godwin Emefiele, the former Governor of the Central Bank of Nigeria (CBN), raised eyebrows due to its unconventional nature, giving the impression of political reprisal.

“The removal of Godwin Emefiele, the previous governor, was overdue. But its manner, initially via a charge of firearms possession, was odd and smacked of political revenge. More substantively, the new exchange rate regime has yet to be properly explained,” the report said.

“On how the new CBN management can stabilize the financial system, the report said the new CBN leadership will most likely increase the interest rates to curb inflation.

“Markets consider Cardoso, a former Citibank Nigeria chair, to be a sound appointment. (The same cannot be said of all of Tinubu’s picks.) The incoming governor will probably need to raise rates at the next policy meeting to establish his inflation-busting credentials. Tinubu must restore institutional independence by leaving the bank to get on with its job. In other areas, the president needs to be more active – and more articulate,” the report said.

It said in other areas, Tinubu needs to be more active and more articulate.

“He should spell out his policies to a skeptical public. He should also refrain from announcing plans — including the restoration of democracy in Niger — without any real idea of how to implement them. Execution is key. Only four months into his presidency, what started out with a bang risks becoming a whimper. Tinubu needs to regain the momentum,” it said.

Headline

EFCC bars dollar transactions, orders embassies to charge in naira

The Economic and Financial Crimes Commission has barred foreign missions based in Nigeria from transacting in foreign currencies and mandated them to use Naira in their financial businesses.

The EFCC has also mandated Nigerian foreign missions domiciled abroad to accept Naira in their financial businesses.

The anti-graft agency said the move is to tackle the dollarisation of the Nigerian economy and the degradation of the naira

The Commission, therefore, asked the government to stop foreign missions in Nigeria from charging visa and other consular services in foreign denominations.

The EFCC gave the advisory in a letter to the Minister of Foreign Affairs, Amb. Yusuf Tuggar, for onward transmission to all foreign missions in the country.

In the letter, the EFCC said it issued the advisory because the practice of paying for consular services in dollars was in conflict with extant laws and financial regulations in Nigeria.

In a letter dated April 5, 2024, which was addressed to the Minister of Foreign Affairs, Ambassador Yusuf Tuggar, titled: “EFCC Advisory to Foreign Missions against Invoicing in US Dollar,” the EFCC Chairman, Ola Olukoyede expressed dismay over the invoicing of consular services in Nigeria by foreign missions in dollars.

The EFCC cited Section 20(1) of the Central Bank of Nigeria Act, 2007, which makes currencies issued by the apex bank the only legal tender in Nigeria.

The letter read, “I present to you the compliments of the Economic and Financial Crimes Commission, and wish to notify you about the commission’s observation, with dismay, regarding the unhealthy practice by some foreign missions to invoice consular services to Nigerians and other foreign nationals in the country in United States dollar ($).

“It states that ‘the currency notes issued by the Bank shall be the legal tender in Nigeria on their face value for the payment of any amount’.

“This presupposes that any transaction in currencies other than the naira anywhere in Nigeria contravenes the law and is, therefore, illegal.”

The commission further stated that the rejection of the naira for consular services in Nigeria by certain missions, along with non-compliance with foreign exchange regulations in determining service costs, is not just unlawful but also undermines the nation’s sovereignty embodied in its official currency.

The letter continues: “This trend can no longer be tolerated, especially in a volatile economic environment where the country’s macroeconomic policies are constantly under attack by all manner of state and non-state actors.

“In light of the above, you may wish to convey the commission’s displeasure to all missions in Nigeria and restate Nigeria’s desire for their operations not to conflict with extant laws and regulations in the country.”

Diplomatic sources said yesterday, May 10, that some embassies were wondering whether the EFCC’s advisory represented the position of the Federal Government.

Headline

Prince Harry visits sick Nigerian soldiers in Kaduna

Prince Harry and his team visited the 44 Nigerian Army Reference Hospital in Kaduna to interact with wounded soldiers who are receiving treatment.

The Duke of Sussex is in Nigeria with his wife to champion the Invictus Games, which Harry founded to aid the rehabilitation of wounded and sick servicemembers and veterans.

Nigeria joined the Invictus Community of Nations in 2022 becoming the first African country to join.

Prince Harry’s visit to Kaduna came 68 years after his late grandmother Queen Elizabeth II visited the state during the time of the late Premier of Northern Region Sir Ahmadu Bello.

-

Headline5 days ago

Headline5 days agoSuspend cybersecurity levy– Reps to CBN

-

Business5 days ago

Business5 days agoNigeria needs over $2bn to revive Ajaokuta Steel Plant, says Minister

-

Headline3 days ago

Headline3 days agoPrince Harry visits sick Nigerian soldiers in Kaduna

-

Entertainment3 days ago

Entertainment3 days agoAMVCA Cultural Day: BBNaija’s Neo, Venita win Best Dressed Male, Female

-

Headline5 days ago

Headline5 days agoTinubu resumes work after foreign trip

-

News5 days ago

News5 days agoShan George’s money returned to Zenith Bank account

-

Metro3 days ago

Metro3 days agoEx-Sports Minister laments after hospital neglected him for hours over N80000 deposit