News

Tinubu Has Dodged Poisonous Knife By Not Appointing El-rufai – Shehu Sani Mocks

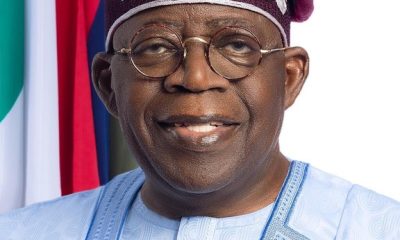

A former senator who represented Kaduna Central at the 8th Senate, Shehu Sani, on Wednesday mocked the immediate past governor of Kaduna State, Nasir El-Rufai for missing out in the recent appointments made by President Bola Tinubu.

Tinubu appointed a former Governor of Benue State, George Akume as Secretary to the Government of the Federation while the outgoing Speaker, House of Representatives, Femi Gbajabiamila was appointed the Chief of Staff.

Akume, who was sworn-in by the President on Wednesday at the Aso Villa, had served during the second tenure of the former President Muhammadu Buhari as Minister of Special Duties and Intergovernmental Affairs.

Before Akume and Gbajabiamila were appointed, insinuations were rife in various quarters that the former Kaduna State governor would get one of the positions considering his closeness to the President during electioneering.

Reacting to the development, Sani, who was apparently referring to comments credited to El-Rufai on Islamisation agenda, said Tinubu had “dodged a poisonous knife” by scheming the former governor out of the two positions he described as “critical”.

“If Tinubu had appointed ‘Mr Over Sabi’ as SGF or Chief of Staff, he would have sown the seed of discord between the President and the Vice President, speak and move around as more important than the two. Tinubu has dodged a poisonous knife,” Sani said in a tweet on Wednesday afternoon.

El-Rufai was alleged in a trending video on social media to have said that the Muslim-Muslim ticket in the Kaduna governorship election would be sustained beyond 20 years in the state.

In the video, the former governor, who spoke in Hausa, also claimed that Muslim domination was being replicated at the national level, and that the victory of President Bola Tinubu had silenced his critics, particularly the Christian Association of Nigeria.

News

Woman killed while crossing road in Anambra

The Federal Road Safety Corps (FRSC), Anambra State Sector Command, has confirmed the death of a woman in an accident at Okpoko Market on the Asaba-Onitsha Road.

The Sector Commander, Mr Adeoye Irelewuyi, who confirmed the accident to journalists in Awka on Thursday, said that the woman was hit while she was crossing the road.

He said that the accident, which occurred on Wednesday, involved a commercial tow truck with registration number XA550BMA.

“Eyewitness report reaching us indicates that the truck was towing a vehicle in an uncontrollable speed along the axis.

“The vehicle that was being towed got detached from the tow truck.

“It hit and killed a female adult, who was said to be crossing the road, while the tow truck continued its movement.

“FRSC rescue team came to the scene and took the woman to Toronto Hospital, Onitsha, where she was confirmed dead and her body deposited at the hospital’s mortuary,” he said.

While sympathising with the family of the dead, the sector commander urged motorists, especially tow truck drivers, to exercise a high level of professionalism.

He also urged the drivers to always use standard equipment and avoid speeding.

News

LASG’s maize palliative impactful, says poultry association chair

The Chairman, Poultry Association of Nigeria (PAN), Lagos State Chapter, Mr Mojeed Iyiola, said the state government’s maize palliative to members of the association made a positive impact on the sector.

Iyiola said this in an interview with the News Agency of Nigeria (NAN) on Thursday in Lagos.

“We received about 150,000 tons of maize in February from the Lagos State government as palliative to cushion the effect of high feed prices.

“The major benefit of the palliative is that it actually cushioned the cost of production for most poultry farmers in the state.

“The palliative was beneficial as it made the cost of some poultry produce, especially eggs to drop,” Iyiola said.

He noted that prior to the palliative, a crate of egg was sold between N3,500 and N3,700 at the farm gate, but after the palliative, it now sells between N3,200 and N3,400.

According to the PAN chair, retailers and middlemen who sell from N3,800 to N4,200 do that for their personal gain.

“We have urged our members to sell their eggs at reasonable prices following the receipt of the palliative from the government.

“We appreciate the Lagos State government for the palliative but we also urge the federal government to do likewise, to further reduce the cost of production in the sector.

“This will consequently lead to drop in the prices of all poultry produce across board,” he said.

He said the palliative was shared among financial members of the association at no extra cost.

“As an association we shared the grains equally across PAN’s eight zones in the state equally. We also mandated each zone not the sell even a grain of the maize.

“We, however, considered new poultry farmers who wanted to the join the association as beneficiaries of the palliative,” said Iyiola.

He noted that through the palliative, more poultry farmers were recruited into the association.

“The maize was shared only to poultry farmers and not feed millers, it is the major component of poultry feed formulation,” he said.